Understanding Financial Transparency in Fiduciary Wealth Management

Financial transparency is the backbone of trust in fiduciary wealth management. When you entrust your assets to a fiduciary, you want to know exactly where your money is going, how it’s being managed, and why certain decisions are made. A fiduciary is legally bound to act in your best interest, and this includes being open about fees, costs, and any potential conflicts of interest.

Knowing every detail isn’t about nitpicking—it’s about security and confidence in your financial future. Financial transparency ensures you’re not in the dark about any aspect of your wealth management. It means clear, straightforward reporting of your investments, easy-to-understand fees, and open communication about the strategies employed to grow your wealth.

Fiduciaries who prioritize transparency don’t just throw complicated financial jargon your way. They explain your financial picture in simple terms and make sure you understand the impact of every financial move. This clarity is crucial, because it empowers you to make informed decisions alongside your wealth manager.

In summary, understanding financial transparency is non-negotiable in fiduciary wealth management. It’s about protecting your interests, maintaining open lines of communication, and having the clear insights needed to watch your wealth flourish.

The Importance of Financial Transparency for Trust and Accountability

Financial transparency lies at the heart of trust in fiduciary wealth management. It’s the difference between feeling secure about where your money’s going and lying awake worried. Here’s the deal: when advisors lay all the cards on the table—fees, strategies, and potential conflicts of interest—you know they’re playing for your team. It knocks down walls of doubt and builds a fortress of credibility. Think about it. Would you rather team up with someone who’s whispering behind closed doors or the one who’s whisper-clear about your cash? No contest, right? Absolute clarity in finances isn’t just nice to have; it’s a must for nailing down rock-solid trust. Factor in regular detailed reports, and you’re not just in the loop; you’re in control. That’s what accountability looks like—no ifs, ands, or buts about it. Transparency isn’t just about avoiding nasty surprises; it’s about partnership, empowerment, and peace of mind. And isn’t that what we all want for our hard-earned dough?

How Financial Transparency Benefits Clients

Financial transparency is a cornerstone in fiduciary wealth management, acting like a beacon guiding clients through the fog of financial jargon and complex products. It breeds trust and lays all cards on the table, ensuring that clients have a clear view of their financial landscape. For starters, it means wealth managers must disclose any fees and commissions they earn from the products they recommend. No hidden charges, no surprises. This approach empowers clients, because when you know what you’re paying for and why, making informed decisions becomes second nature. Plus, transparency goes beyond dollars and cents; it’s about being straightforward about the potential risks and returns of investments. This full disclosure means clients can align their expectations realistically with market conditions. When clients have a transparent relationship with their wealth managers, they’re more likely to stick around long-term, because trust has been established and the path ahead is clear. So, while some advisors might shy away from too much honesty, fearing it could scare clients off, the opposite is true with fiduciary wealth management. Here, financial transparency is not just good practice — it’s a fundamental promise to the client.

Fiduciary Duty Explained: The Legal Obligations

Fiduciary duty is like a sworn promise from your wealth manager that they’ll act in your best interest, not just aim for big profits for themselves. It’s a legal must-do, not a maybe. In plain talk, this means your financial advisor has to be transparent about how they manage your money and they’ve got to put your financial needs first, no shady business. Think of it like they’re the captain of your ship, and they’ve got to navigate your wealth through rough or calm waters with care and loyalty. If they mess up or put their own interests over yours, it’s not just a no-no, it’s a breach of trust and they can get in legal hot water. In short, fiduciary duty is your safety net, ensuring the folks handling your dough are doing right by you.

Key Aspects of Financial Transparency in Wealth Management

In wealth management, financial transparency forms the bedrock of trust between a client and their advisor. It’s all about clear, straightforward communication. Here’s the deal – clients need to know where their money is going, how it is being managed, and why certain investments are chosen. Financial transparency includes regular, detailed reports on investment performance, fees, and any changes in strategy. It also means that wealth managers should always act in the best interests of their clients, keeping them in the loop. This approach not only builds trust but also empowers clients to make informed decisions about their financial future. Transparency isn’t a buzzword in this industry; it’s a must-have for any decent advisor worth their salt.

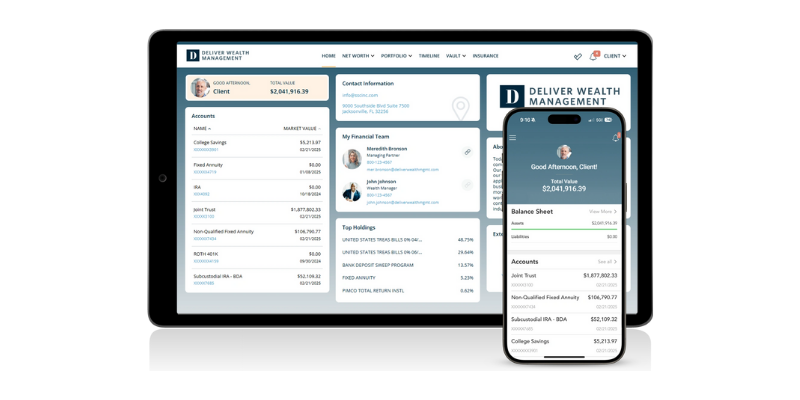

Tools and Practices for Maintaining Financial Transparency

In fiduciary wealth management, financial transparency isn’t just a buzzword; it’s the foundation of trust between a client and an advisor. The key tools and practices that ensure this clarity include clear reporting, open communication, and the use of technology. First up, detailed reports that break down investments, performance, and fees are a no-brainer. Clients should see where every penny goes. Transparent conversations about risks, rewards, and investment strategies also keep clients in the loop. Advisors should be as clear as daylight about the choices they make. And let’s not forget technology – today’s digital platforms offer real-time access to financial data, such that clients can peek into their portfolios anytime, anywhere. Keeping everything out in the open, with no hidden cards under the table, builds a solid rapport that’s good for both the client’s peace of mind and the health of their wealth.

The Impact of Transparency on Investment Strategies

When managing your wealth, knowing where every penny goes is crucial. It’s about building trust. Financial transparency ensures you’re informed about how fund managers make decisions and what they’re investing in. When strategies are transparent, you’re in the driver’s seat, understanding the risks and why certain assets are in your portfolio. With transparency, you can gauge if your investment philosophy aligns with the managers’ approaches. It also means fewer surprises. You’re less likely to find hidden costs or investments that don’t match your values. Transparency is not just good practice; it’s about having the confidence to see your wealth grow based on clear, understandable strategies.

Communicating with Clients: Reports and Disclosures

When it comes to managing someone else’s wealth, trust is everything. That’s why communicating clearly with clients through regular reports and disclosures is a must in fiduciary wealth management. Every client deserves to know exactly what’s happening with their money. We’re talking about providing detailed accounts of transactions, investment performance, and fees—all broken down so there’s no room for confusion. Reports should be straightforward, updating clients on where they stand and what actions are being taken on their behalf. It’s not just about numbers on a page, but giving clients the peace of mind that their financial future is being handled with care and expertise. Regular disclosures also help ensure that there’s no unpleasant surprises down the road. With transparency at the forefront, clients can feel confident that every decision made is in their best interest.

Overcoming Challenges to Achieve Full Financial Transparency

In fiduciary wealth management, achieving full financial transparency is a stark road with its bumps. Clients may not always see where their money goes, how it’s managed, or the actual cost of investments. That’s why, as fiduciaries, wealth managers shoulder the duty to clear the fog and lay out financial details bare. But this isn’t a walk in the park. They fight against complex financial products that muddy the waters, making transparency a hard-won battle. Add to that, regulations change, and keeping pace demands vigilance.

Fiduciaries often turn to technology as well-equipped allies in this fight for clarity. Platforms that track and display financial info without a smokescreen are rising, helping advisors showcase where every dime stands. Yet, it’s not all about the tools. Communication is key. A fiduciary must speak plainly, avoiding financial jargon that confuses more than it clarifies.

In the end, regaining trust is the prize. When clients see through the clear glass of their financial dealings, their confidence in their wealth managers solidifies. Overcoming the challenges of financial transparency isn’t just about compliance; it’s about building robust relationships grounded in trust.

The Future of Financial Transparency in Wealth Management

The future of financial transparency in wealth management is bright, with more investors demanding clarity. Picture a world where every charge, every fee, every penny going in and out of your investment is crystal clear. That’s where we’re headed. Why? Because trust is the bedrock of a strong client-advisor relationship, and transparency is trust’s best friend. Gone are the days of hidden fees and confusing statements. Today’s advisors must be open books, providing easy-to-digest breakdowns of their services, how they’re paid, and where a client’s assets are going. It’s not just good practice; it’s becoming a standard. Clients are savvier, regulations are tighter, and technology enables unprecedented access to information. The trajectory points to a future where financial transparency isn’t just a nice-to-have; it’s the norm. Embrace it, and you’ll likely see stronger, more trusting relationships flourish with your clients.