Another question we receive a lot comes in many forms, such as; “Is now a good time to buy stocks?” or “Should I wait for the next correction to invest?” or “should I wait till after the election to invest?” and “Should I sell and go to cash when the market starts to fall?” All of these questions lead to one bigger question, can you time the market?

The ability to take all the stock market gains and avoid the losses is certainly very appealing. This is why insurance companies have created products that claim they do just that, although, after further inspection of these products, it is revealed that their return is more closely correlated to a checking account than the stock market. However, this desire for all gains and no losses is also behind the desire to time the market.

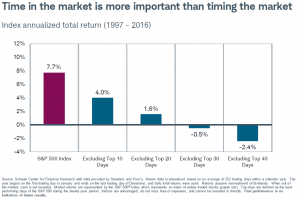

How precise do you need to be to time the market? Here is a graph that shows the annual return of the S&P 500 index over a 20 year period.

If you were invested for the entire 20-year time frame, your return was 7.7% per year annualized. But look at what happens when you missed the 10 best days over that same 20 year period. Your investment drops to 4% annually. Think you are good enough to guess the 10 best days of the market over a 20 year period? Digging deeper, look at how missing the 40 best days turns your annual return negative.

So, what is an investor to do? First, you must have a long-term plan that takes into account the ups and downs of the stock market. Secondly, you need a portfolio asset allocation that works for your specific goals, risk tolerance, and time frame. When economic times get tough, don’t panic! If you have done your asset allocation correctly you should have some safe money allocated to bonds and cash to get you through till the next bull market.

Also, don’t make investment decisions based on financial news stories. These stories are designed to evoke fear or greed in you so you will keep watching. Think rationally about your investments; if you owned a lemonade stand would you sell it because it rained over the weekend? On the other side of the coin, watch out for hot stock tips or not having realistic investment performance goals. Greed can mess up your investments as easily as fear.

Finally, adding to your savings regularly and having a good understanding of your investments should also help you avoid the lure of timing the market. And when times get tough, it is beneficial to focus on your long-term goals.

Bull markets and bear markets will never last as long as you think they will. Before you or a loved one let your emotions make a financial decision that you will later regret, give us a call and let one of our experts discuss the best options for you. Call us at (904) 223.0510.