When Americans are polled on what their biggest financial regret is, the number one answer, no matter which survey you view, always seems to be “not starting to save for retirement sooner.” I believe this occurs because at some point in people’s lives they sit down and take a hard look at their finances and realize that if they had just had a plan sooner they could have done more with less. Albert Einstein has been thought to have said “The most powerful force in the universe is compound interest.” Whether or not Einstein said that has been a matter of debate, but there is no debate on whether or not compound interest is a powerful force. The understanding of this concept is what I believe leads to the regret of not starting sooner in saving for retirement.

What is compounding?

Compounding is the process of generating earnings on an asset’s reinvested earnings. To work, it requires two things: the re-investment of earnings and time. The more time you give your investments, the more you are able to accelerate the income potential of your original investment.

Here is an example: If you invest $10,000 today at 8 percent, you will have $10,800 in one year ($10,000 x 1.08). Now, let’s say that rather than withdraw the $800 gained from investing, you keep it in there for another year. If you continue to earn the same rate of 8 percent, your investment will grow to $11,664 ($10,800 x 1.08) by the end of the second year. The second year you earned $864 which is $64 more in earnings than the previous year. This may seem small but fast forward to the 10th year and your $10,000 initial investment is earning $1,599 a year at the same 8 percent return rate.

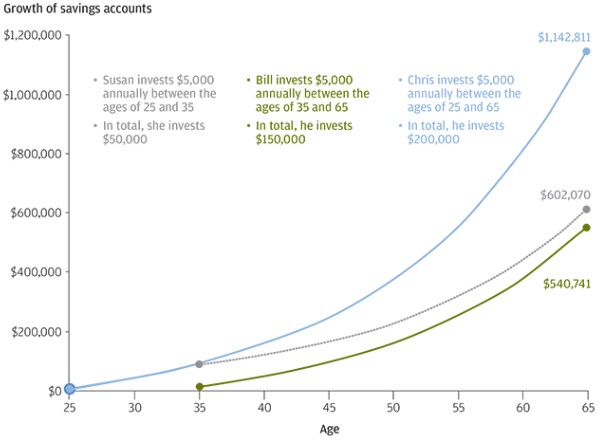

This is a chart that I pulled from the JP Morgan website.

This example consists of three people who experience the same annual return on their retirement investments:

- Susan, invests $5,000 per year, only from ages 25 to 35 (10 years).

- Bill, also invests $5,000 per year, but from ages 35 to 65 (30 years).

- Chris, also invests $5,000 per year, but from ages 25 to 65 (40 years).

Naturally, it makes sense that Chris would end up with the most money. But the amount he has saved is exceedingly larger than the amounts saved by Susan or Bill. Susan, who saved for 10 years, has more savings than Bill, who saved for 30 years. That difference is explained by compounding. The longer you wait to start saving for retirement, the more you miss out on the benefits of time.

It’s not too late!

No matter what your age, the time to take advantage of compounding is now. Workplace retirement accounts and IRAs are a great place to start, but the important thing is to begin now. Need help on investments and putting together your custom plan? That’s where we would like to help. Please give us a call and let one of our advisors help you get your money working as hard as you do.