Even if you are self-employed, you have until April 18 to lower your taxes and save for retirement!

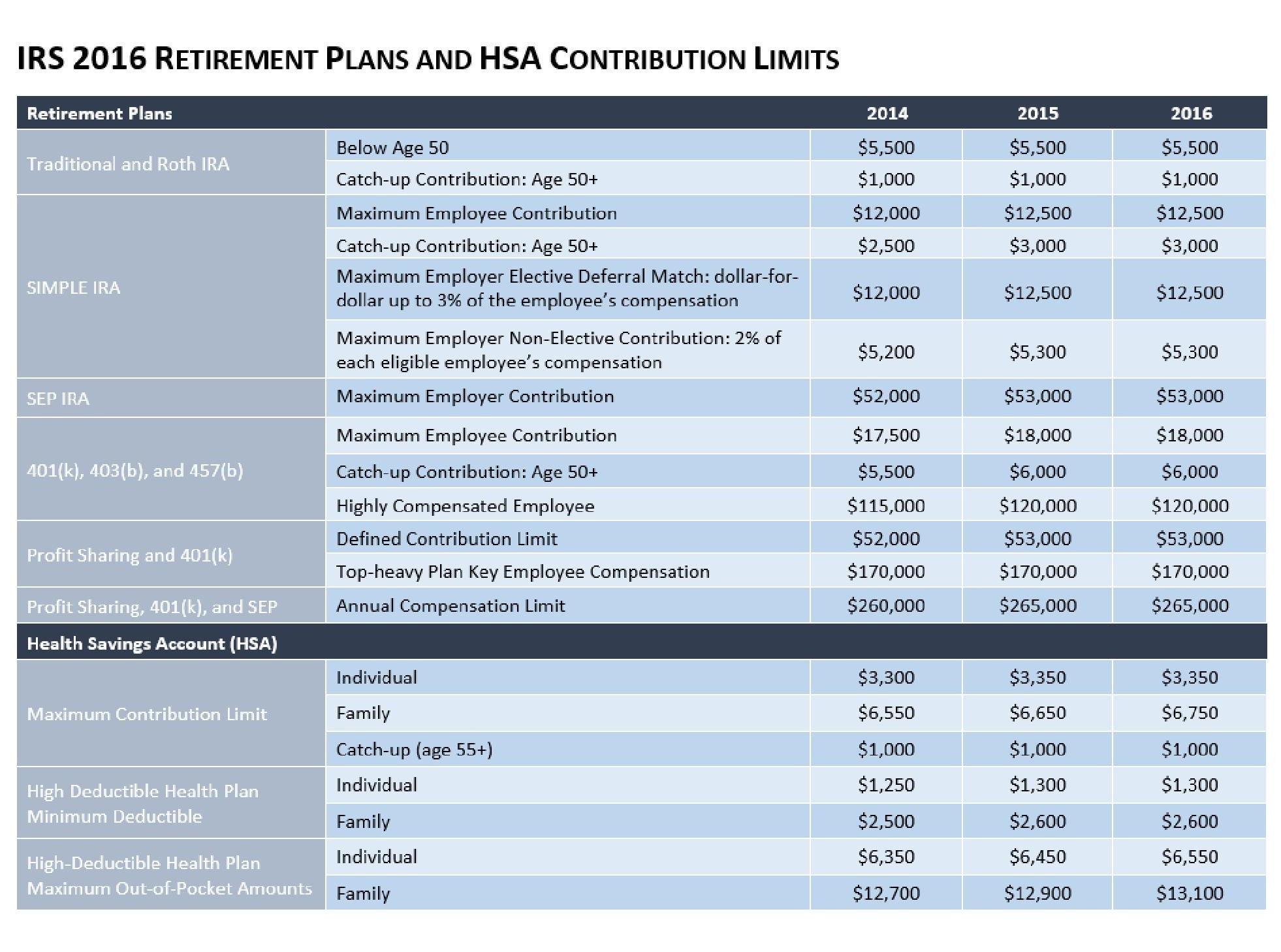

As the 2016 tax deadline approaches, remember that there is still time to open and fund an Individual Retirement Account (IRA) for 2015 – which can help you save on taxes due and provide a nest-egg for your retirement years. If you are self-employed, there is still time for you to lower your taxable income by as much as $53,000 by contributing to a Simplified Employee Pension Plan (SEP) IRA. For those who are not self-employed, you could cut as much as $5,500 out of your taxable income by contributing to a traditional IRA. Some of the highlights from the 2015 and 2016 tax code on retirement contributions can be found below.

2016 Changes

The amount workers can contribute to 401(k) and IRA accounts will mostly stay the same in 2016. Inflation, as measured by the Consumer Price Index (CPI), did not increase enough to justify raising the contribution caps. According to a statement from the IRS, “Some pension limitations such as those governing 401(k) plans and IRAs will remain unchanged because the increase in the CPI did not meet the statutory thresholds for their adjustment.” Some of the income thresholds that allow savers to qualify for tax deductions and credits will increase next year. Here’s a look at how IRA rules will change in 2016:

IRA contribution limits unaffected. The limit on IRA contributions will remain at $5,500 in 2016. Individuals age 50 and older can contribute an additional $1,000.

Small business owners and the self-employed can really cut the tax bill. There are a wide variety of plans depending on if you have employees or are a sole member, but for SEP IRAs, individuals may contribute 25 percent of their income, up to $53,000 for 2015 and that limit will not change in 2016. Other plans like a solo 401(k) may allow for higher contributions, but new plans will miss the cut-off date for 2015.

Traditional IRA income cutoffs remain the same. Savers who have a workplace retirement account can claim an additional tax deduction for IRA contributions, unless their income exceeds certain annual limits. The IRA tax deduction is phased out for singles and heads of households whose modified adjusted gross income is between $61,000 and $71,000, the same as in 2015. The income phase-out range is $98,000 to $118,000 for married couples when the spouse who contributes to the IRA also has access to a workplace retirement plan. There are no income limits for the IRA tax deduction for people who don’t have a retirement account at work.