Do you have an overall financial plan for your life? What guides your decisions?

Life’s journey can be like taking a vacation. You plan your transportation, where you will be staying, and what you will do when you get there. And you want to be prepared, if weather, kids, car trouble or traffic alters your plans.

When it comes to financial planning, you face similar dilemmas and you often make changes in order to reach your planned financial destination. Having a plan in place and knowing when to alter it can be very useful. Here are some events to look out for.

- Getting married /having kids: Maybe it’s combining two incomes, thinking about education for children, buying a home, or realizing that one day you both want to retire, this can be the most important time to get on the right track.

- I got a raise!: An increase in income may seem to justify more frivolous spending, but this should be done within your long-term financial plan. Most plans incorporate increased savings into the model, so make sure you’re not shooting yourself in the foot by taking the family to visit your aunt in Fiji. Raises also make a great time to increase savings if you have not been previously doing so. Since you have not incorporated the money into your budget yet, you won’t have to give up any aspects of your current lifestyle to increase your savings rate.

- Losing a job: This can be mentally and financially upsetting, but the sooner you adjust to your new income level, the less impact it will have on your long-term goals. If you don’t adjust your spending to your new level of income, you may be setting yourself up for a much bigger headache.

- Doing what you always wanted to do: Sailing around the world, starting your own business, or buying that log cabin in the mountains; having a plan to buy and meet the expenses associated with your dreams takes time and planning. You don’t want your vacation trip to come at the expense of your other financial goals.

- Getting your lifestyle goals in priority: You may want to retire early or visit your aunt overseas, instead of having a big home or other luxuries; by having your plan in place, you can make choices as to what’s most important to you.

- The death of a loved one: A death may result in financial changes for you to consider. Stay on track by incorporating financial changes, including loss of income or an inheritance, into your plan.

- Investment gains/losses: A great return on your stock portfolio may make you feel like you have newfound wealth. Resist the urge of spending this gain, as you may need a cushion for future years that may not be as fruitful. The reverse is true for investment losses. Having a plan for your investments based on your risk level and time frame is imperative. Yearly gains and losses are to be expected, stay invested, and focused on your long-term plan. This will almost always bring you your best returns.

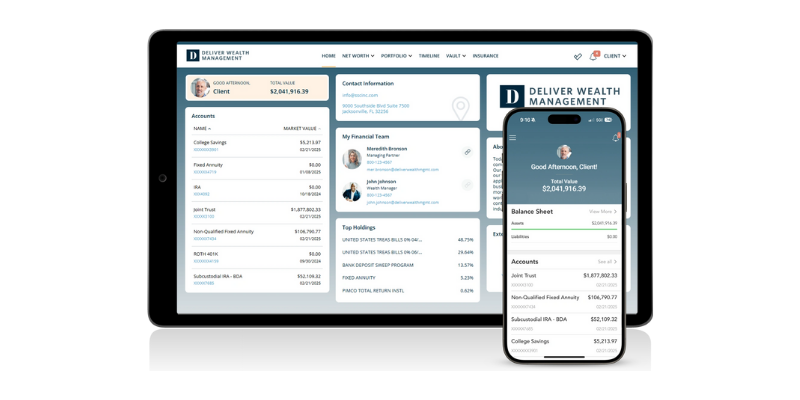

Long-term financial planning is a key part of creating wealth over time. Building an effective long-term financial plan can seem daunting, and many people get scared of the idea, unsure of how they will be able to plan that far in advance. This is where an advisor can assist: they create, alter, and monitor financial plans on a daily basis and can make the process simple and durable.

If you need a written financial plan to prepare for the events in your life, we can help.